In August 2015, according to China Customs, China exported 83,477 tonnes of

aluminium fluoride (AlF3) in H1 2015, up by 9.06% over that of 76,541 tonnes in

H1 2014.

The active export activity was mainly impacted by the languishing demand in

domestic market.

Specifically, the electrolytic aluminium industry, which plays a vital role in

the AlF3 downstream application, was regulated by the government policy to ease

the overcapacity. This, together with the poor economic conditions nationwide,

forced the enterprises to frequently down-regulate the operating rates, which

further weakened the demand for AlF3.

Meanwhile, the AlF3 industry was also trapped in severe overcapacity: low price

unable to rebound, profit margin narrowed down and operation pressure enlarged.

"In H1 2015, the loss from the domestic orders was about USD49.04/t

(RMB300/t)", said a sales manager. (Loss= ex-works price - cost from raw

materials and other costs)

In addition, the export rise can also be ascribed to the market expansion

launched by many AlF3 enterprises in overseas markets in 2014, from which

orders were made and further be delivered in 2015. For instance:

March 2014: Ningxia Hui Autonomous Region realised the first export of

AlF3 via Ningxia King Chemicals Co., Ltd.

April 2014: both Gansu Province and Chenzhou City (Hunan Province) broke

the zero AlF3 export via Baiyinzhongtian Chemical Co., Ltd. and Yizhang

Hongyuan Chemicals Co., Ltd. respectively

December 2014: Do-Fluoride Chemicals Co., Ltd. successfully stepped into

Russia with its AlF3

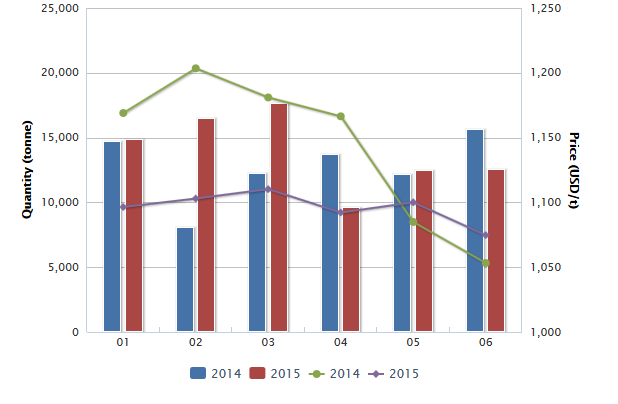

Export trend of aluminium fluoride in China, H1 2014 & H1 2015

Source: China Customs & CCM

CCM predicts that the AlF3 export will continue being active in H2 2015. This

is mainly because:

- Continuously sluggish domestic AlF3 market. Specifically, the electrolytic

aluminium manufacturers have down-regulated the operating rates since late

July, influenced by the largely decreased spot price of aluminium – down by 3%

MoM and 9% YoY to USD1,962/t (RMB12,000/t) in July.

This further decreased the

demand for AlF3 and exerted great pressure on the AlF3 producers. According to

CCM research, some AlF3 producers, including Luoyang Fengrui Fluorine Co., Ltd.

(30,000 t/a), Zhuzhou Guangcheng Chemical Co., Ltd. (20,000 t/a) and Jiangxi

Fufeng Chemical Co., Ltd. (15,000 t/a) have started to halt production since

August and have planned to restore production until mid September.

- Gradually upward trend in AlF3 export. Due to the overcapacity and the poor

domestic demand, export has become a major channel for AlF3 producers to do

business.

H1 2013: +20.08% YoY

H1 2014: +12.02% YoY

H1 2015: +9.06% YoY

In view of the export trend in recent years, the exports in H2 will be larger

than that in H1. In Q4 particularly, the foreign downstream enterprises are

more willing to stock the warehouses, which will distinctly drive up the

demand.

In addition, since mid August, the RMB/USD exchange rate has been sharply

declining. By 27 Aug., the fall had reached 4.78% (USD1=RMB6.1162 on 10 Aug.

vs. USD1=RMB6.4085 on 27 Aug.). This, to some extent will encourage the foreign

countries to increase the imports from China. The domestic AlF3 producers who have

succeeded in developing overseas markets and have got steady orders, stated to

continue increasing the export to satisfy the demand.

This article comes from China Fluoride Materials Monthly Report 1508, CCM

About CCM:

CCM is the

leading market intelligence provider for China’s agriculture, chemicals, food

& ingredients and life science markets. Founded in 2001, CCM offers a

range of data and content solutions, from price and trade data to industry

newsletters and customized market research reports. Our clients include Monsanto,

DuPont, Shell, Bayer, and Syngenta. CCM is a brand of Kcomber Inc.

For more

information about CCM, please visit www.cnchemicals.com or get in touch with us

directly by emailing econtact@cnchemicals.com or calling

+86-20-37616606.